Pursuant to the California Penal Code, car insurance fraud is defined as any incident, conduct, or omissions that the Defendant is a part of, with the intent to defraud an car insurance company. The laws surrounding car insurance fraud in California are convoluted, and the attorneys at Orange County Criminal Attorney (“OCCA”) are experienced in defending charges of that nature. When accused of car insurance fraud, you face potentially extreme consequences. As such, it is imperative that you are represented by counsel a complete understanding of the law as it relates to charges of this nature.

EXAMPLE:

- Julia abandons her car in Joshua Tree, with the intent to file a claim with her insurance and get the money to replace her “stolen vehicle.”

- A man, over his head in debt sets his house ablaze in an effort to obtain insurance money. (this is another form of insurance fraud, not car)

- A woman asks an car repair shop to “fluff” up the receipt so she can receive a little extra money from her insurance company.

Pursuant to the California Penal Code, an individual is guilty of car insurance fraud when they do any of the following acts: (hide, abandon, or damage a vehicle for the purpose of collecting car insurance funds, (2) submitting a fraudulent car insurance claim for loss due to destruction, theft, or damage, while being aware that their claim is fraudulent, (3) presenting more than one car insurance claims, knowing they are duplicative, with the intent to defraud the insurance company, (4) participate, or cause, and car accident intending to wrongfully collect insurance proceeds; and/or prepare, or present a statement connected to a claim for insurance, which contains false or misleading information; and knowing that this information is false or misleading. Additionally, you can be found guilty under this statute if you lie about what part of California you reside in on an car insurance application.

The car insurance statute also creates a punishable offense as it relates to worker’s compensation claims, lying about your residence, or anything else designed to obtain more money through insurance claims. It is important to be aware that you will also be held culpable if you assist another person in committing insurance fraud. An example of this liability for helping another person commit insurance fraud would be a business owner accepting another person’s business, despite the owner’s knowledge that the individual intends to commit insurance fraud (see the example about requesting a fake receipt above; if the company does it, they are also on the hook if they are charged with insurance fraud.

Ultimately, there four (4) distinct scenarios as it relates to car insurance fraud. It is probable that an individual will be charged with car insurance fraud if they file a false claim, which they know is false, with the intention of being paid insurance money they are not entitled to. Another example would be if an individual set their car ablaze with the intention to collect insurance money. A third example would be an individual filing a claim for their stolen vehicle, but lies and says there was $3,000 cash in the car at the time it was stolen (assuming they are lying). Finally, another common form of car insurance fraud that occurs, is an individual lying about their residence in an effort to obtain a lower insurance rate. All of these are precisely the type of conduct the statute prohibiting car insurance fraud is attempting to punish. If you have committed any of these actions, and the Prosecution can prove it beyond a reasonable doubt, you will likely be found guilty of this crime. Having competent counsel on your side, advocating your innocence can go a long way; be it talking with the Prosecutor in the hopes of a lesser charge, utilizing the facts to negate elements of the Prosecution’s case, or advocating for the lowest penalty available.

What Is The Legal Definition Of Car Insurance Fraud In California

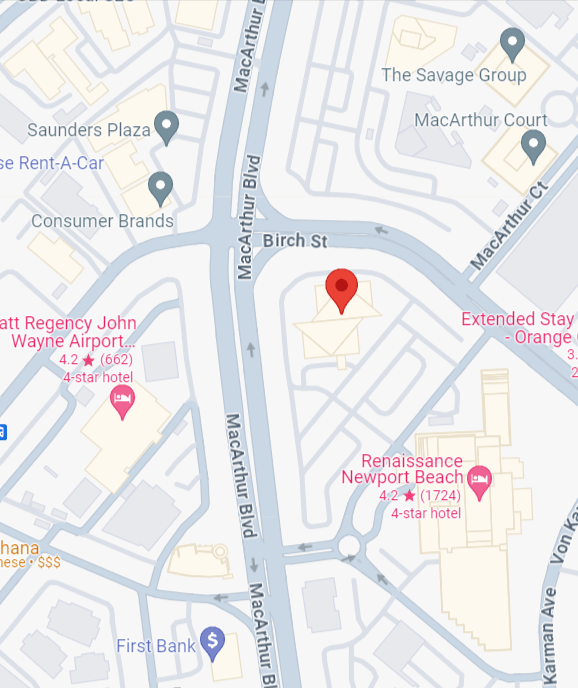

California Penal Code §§ 548 and 550 establish various forms of car insurance fraud. The charge and the punishment are dependent on the facts of your case. To better understand the various charges and penalties, it is important to understand the various factors that could impact the outcome. The attorneys at OCCA have ample experience defending various criminal charges, including car insurance fraud; they’re in-depth understanding of the law may allow you to avoid being convicted altogether. If nothing else, their understanding of a convoluted law may allow you to receive sentences, which are lower on the spectrum than you might obtain otherwise. If you have been charged with car insurance fraud under California Penal Code §548 or §550, contact an attorney at Orange County Criminal Attorney immediately.

Section 548 Pc - Damaging Or Abandoning Vehicle

Pursuant to California Penal Code §548 it is a crime if you injure another person, or abandon, destroy, or dispose of a vehicle that is insured against damage or loss, with the intent to defraud an insurance company, it is probable that Prosecution will pursue charges against you under §548 of the Penal Code.

There are two elements the Prosecution needs to prove beyond a reasonable doubt in order to obtain a conviction under Penal Code §548 – car insurance fraud:

- You destroyed, abandoned, hid, injured, or disposed of property that was insured against that act (excluding fire); and

- At the time of this act, your subjective intent was to defraud the insurance company.

Courts have found that intent to defraud means an intention to deceive the insurer and deprive them of money, legal remedies, or property rights.

You may still be convicted of car fraud under Penal Code §548, even if the insurance company never actually lost money. The mere fact that you tried to defraud them is sufficient to maintain a conviction under this section.

If you are convicted under California Penal code §548, then Penal Code §1170(h) states that you may be sentenced to jail for either two, three (3), or five (5) years. You may also incur a fine of up to fifty-thousand dollars ($50,000).

Penal Code 550 Pc Fraudulent Claims

If you helped another person commit insurance fraud, the Prosecution will likely charge you under California Penal Code §550 (If you did the act they can charge you under this as well). This section makes it punishable to solicit, abet, conspire, or aid, with any person to do any of the Following: lie about whether you are entitled to be reimbursed on you claim for the payments of a loss for theft, destruction, damage, or conversion of a motor vehicle, or any part of a car.

To be convicted under California Penal Code §550, the Prosecution must prove the following two elements beyond a reasonable doubt:

You lied when you claimed a loss as a result of theft, damage, conversion, or destruction of your vehicle; the defendant claimed a right to reimbursement as a result of theft, destruction, or damage. You were aware that this was fraudulent, or that the person you were helping was lying; and

You, or someone you were helping, provided the insurer with the claim, intending to defraud them.

Penal Code 550 Pc Multiple Claims

California Penal Code §550(a)(4) makes clear that if you: solicit, aid, abet, or conspire with another person to “to lie that you are entitled to payment of a loss for theft, destruction, damage, or conversion of a motor vehicle, a motor vehicle part, or contents of a motor vehicle”, is a punishable offense.

In order to be found guilty under this statute, the Prosecution must prove the following three elements beyond a reasonable doubt:

- You presented more than one claim, for an identical loss, to the same, or multiple insurance companies.

- You were aware that you were filing multiple claims for an identical loss.

- In filing those multiple claims for identical losses, you intended to defraud the insurance company (ies) with intent to defraud.

- Penal Code 550 PC causing an accident

- Under Penal Code §550(a)(3), you have violated the law when you participate in an accident involving vehicles for the purpose of filing false/fraudulent insurance claims, and are aware of that fact.

To be found guilty of violating §550(a) (3), the Prosecution must prove the following 3 elements beyond a reasonable doubt:

- You either caused, or participated in an accident involving vehicles;

- You had knowledge that the goal of the collision was to provide an insurance company with false claims.

- When the participated, or caused, the accident, your intent was to defraud the insurance company.

What Are The Penalties For Car Insurance Fraud?

If you are convicted in California for the crime of car insurance fraud, the penalties can be harsh. The crime of car insurance fraud is known as a “wobbler offense” in California; this means based on the facts of your case, the Prosecution can charge you with a misdemeanor or a felony.

If you are charged with misdemeanor car insurance fraud, you could face: (1) informal probation, or a fine of up to $50,000 or two times the total amount of the fraud, whichever is higher is the maximum fine you can face.

If you are convicted of felony car insurance fraud, you may face up to five (5) of incarceration, and up to $50,000 in fines, or twice the damage caused by the fraud, whichever is higher will define the maximum fine allowed.

What Legal Defenses Can My Criminal Attorney Make In My Car Insurance Fraud Case?

In California, insurance fraud is responded to forcefully. The amount of money involved is usually what dictates whether it you charge is a misdemeanor or a felony charge. If you have been charged with car insurance fraud, it is critical that you contact an Orange County Criminal Attorney to discuss your case immediately. With the amount of penalties on the line, it is imperative that we begin building you defense from day one. The attorneys at OCCA are ready, willing, and able, to protect you against claims of insurance fraud.

Your attorney from Orange County Criminal Attorney can utilize a wide array of legal defenses to obtain the best possible outcome for you. A major defense your OCCA attorney could put forth, is that your intent was never to defraud the insurance companies at all. The multiple claims were unintentional; often times after an accident people are disoriented, and may forget that they already filed a claim with their insurance company. It is uncommon, but some people simply misplace their cars. There are an infinite number of scenarios where the intent to defraud is not there. Having your OCCA attorney present from the beginning of this ordeal to the end of it, will allow you to proceed through the legal process in as pain free a manner as possible. If ultimately, you are found guilty; your Orange County Criminal Attorney can fight for you to receive the lowest penalty allowable, bringing up mitigating factors in your defense. If you have been charged with Car Insurance Fraud in California, contact an attorney at Orange County Criminal Attorney today.